How to Strengthen Your Grocery Retail Strategy Using Walmart’s Playbook

Walmart isn’t just winning on price—it’s rewriting the playbook on customer loyalty.

When we look at Walmart’s rise in the eGrocery space—its increasing market share, its influence on consumer behavior, its customer base across demographics—the tendency is to credit its pricing advantage.

Through economies of scale, Walmart is able to offer incredibly low prices—especially on center-aisle products from national brands and its own private labels. This pricing power is certainly a major factor in drawing customers.

But thinking of Walmart strictly in terms of discounted prices does the retailer a disservice and leaves grocery retailers at a disadvantage. Focusing only on price overlooks the strategies Walmart has both quietly and not-so-quietly mastered to draw customers away from supermarkets and retain them.

If grocery retailers want to stop losing customers, and regain their market share of online grocery shopping, they need to take action. The best way to do that? Take a page—or several—out of Walmart’s own playbook.

Delivery Discounts to Promote Memberships

How Can Grocery Retailers Adapt It?

Customer Acquisition Costs (CAC)

This article will identify six of Walmart’s most effective customer loyalty strategies and show how grocers can adapt them to fit their unique service offerings. The result? Fewer customers fleeing to competitors, and a stronger hold in the grocery market.

Trying to replicate this strategy without any modification would be a costly mistake for most grocery retailers. Delivery is expensive to serve, and offering steep discounts like Walmart isn’t sustainable for smaller grocers. On top of that, delivery removes the personal, high-touch service that many grocers excel at and distances them from the local experience that sets them apart.

That’s why grocery retailers should take the principles of the strategy, but adapt them for pickup.

While Walmart typically doesn’t charge for pickup, many regional grocers still do. This pricing strategy can actually work in favor of grocers. By offering subscription plans that waive pickup fees or provide additional perks, they can create a unique value proposition that differentiates them from larger retailers.

Pickup plays into what grocers do best: providing high-touch service, operating in convenient local locations, and offering a personalized shopping experience. Pickup also has a significantly lower cost-to-serve compared to delivery, making it a more profitable service for grocers to promote. Customers receive more value through lower costs, and grocers drive repeat business without sacrificing margins to delivery’s higher fulfillment expenses.

This creates a win-win situation for both customers and grocery retailers.

The next strategy we need to look at is Walmart’s use of a wide range of fulfillment options to gain an edge in grocery retail.

Walmart offers customers a variety of ways to receive their orders, from curbside pickup to same-day delivery and even in-home delivery. This flexibility provides customers with convenience at every level, catering to different needs and preferences. By offering multiple fulfillment choices, Walmart ensures that it captures a broad customer base, including both lower-income households who prioritize cost-savings

The next strategy we need to look at is Walmart’s use of a wide range of fulfillment options to gain an edge in grocery retail.

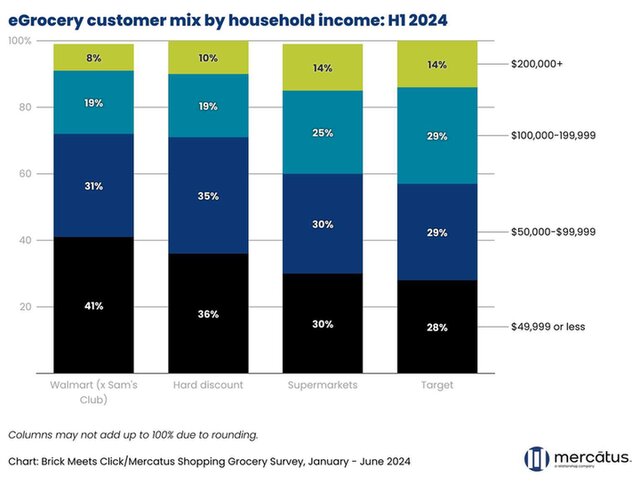

Walmart offers customers a variety of ways to receive their orders, from curbside pickup to same-day delivery and even in-home delivery. This flexibility provides customers with convenience at every level, catering to different needs and preferences. By offering multiple fulfillment choices, Walmart ensures that it captures a broad customer base, including both lower-income households who prioritize cost-savings and higher-income households who prioritize time-saving options.Walmart’s ability to deliver multiple fulfillment methods—all streamlined to meet specific demands from a range of customer segments—has not only increased customer satisfaction but also driven more frequent orders across a wider demographic range. According to the 2024 US eGrocery Shopper Profiles Report from Brick Meets Click, Walmart is making major inroads with affluent households, while also generating retail sales from more budget-conscious consumers.

and higher-income households who prioritize time-saving options.Walmart’s ability to deliver multiple fulfillment methods—all streamlined to meet specific demands from a range of customer segments—has not only increased customer satisfaction but also driven more frequent orders across a wider demographic range. According to the 2024 US eGrocery Shopper Profiles Report from Brick Meets Click, Walmart is making major inroads with affluent households, while also generating retail sales from more budget-conscious consumers.

The first strategy we need to talk about is the one Walmart is using to gain an advantage through its deep delivery discounts, specifically designed to entice membership signups.

Walmart offers significant delivery discounts to anyone who joins Walmart+, its subscription-based membership program. By offering heavily reduced delivery fees as a perk for signing up, Walmart removes one of the biggest obstacles to frequent online ordering: cost.

This tactic encourages new customers to use their delivery service and become members, leading to increased loyalty and more frequent orders that take advantage of the reduced fees.

Recent data from Brick Meets Click/Mercatus Grocery Shopper Surveys highlights just how successful this approach has been with Walmart’s monthly active users outpacing the overall growth of the online grocery market every month since introducing this promotion.

How Can Grocery Retailers Adapt It?

Once again, an exact match of Walmart's strategy wouldn't be practical for regional grocers.

Instead of offering Walmart's full range of services, grocers should focus on optimizing and personalizing the fulfillment options that align best with their strengths.

For many regional grocers, that means doubling down on—you guessed it—pickup services.

Pickup remains the most popular eGrocery fulfillment option, and grocers can leverage this to their advantage. By optimizing their in-store picking process, grocers can enhance the speed and accuracy of order fulfillment, ultimately reducing costs while delivering a better experience to customers.

Here are three practical strategies grocers can implement:

- Define and measure: Defining and measuring operational expectations is crucial; creating a company-wide scorecard for online operations—distributed weekly to store teams—allows tracking of six key KPIs that impact consumer growth and retention (late orders, UPH by picker, OOS percentage, substitution rate, labor utilization, and perfect orders). Gaining the support of store operators by sharing these metrics and defining team goals ensures alignment and effectiveness in grocery retail picking operations.

- Optimize In-store Routing: Train staff on efficient routes or implement mapping tools to reduce the time spent navigating the store. Fewer steps mean faster order completion and lower labor costs.

- Multi-order and zone-picking: Fulfill multiple orders at once by allowing pickers to handle several orders in a single trip through the store. This increases capacity, reduces trips, and boosts efficiency without sacrificing accuracy.

By focusing on optimizing the services they already offer, grocers meet customer needs without stretching resources thin or incurring the high costs of an initiative like in-home delivery. In fact, streamlining eCommerce operations not only improves the customer experience but also enhances overall profitability.

How Can Grocery Retailers Adapt It?

Leveraging First-party Data for Personalization

Many grocery retailers currently rely on third-party platforms like Instacart for delivery services. Just like Walmart, Instacart is also employing deep delivery discounts to attract membership signups and boost grocery sales.

As a result, grocers relying on Instacart’s platform are benefitting from these promotions—which increase retail sales and attract more online grocery spending. However, this is a short-term solution at risk of becoming a dependency that could undermine long-term profitability.

Relying too much on third-party platforms cedes control over critical aspects of the business, including customer data. This is where first-party services—as we see with Walmart—offer a major advantage.

To compete, grocers should develop their own eCommerce and fulfillment services, which allow them to:

- Personalize Offers: Use purchase history to recommend tailored discounts and rewards based on individual preferences.

- Target Promotions: Send timely, relevant promotions based on customers’ buying cycles to increase engagement and repeat purchases.

- Deepen Customer Engagement: Leverage data to create personalized campaigns across email, SMS, and app-based notifications, making the online shopping experience more convenient and engaging.

By focusing on first-party services, grocers can maintain control of customer data, deliver personalized experiences, and seamlessly integrate interactions in both digital and physical retail stores.

The next strategy we need to examine is how Walmart collects, consolidates, and uses first-party data to drive deeper engagement with its customers.

Through its fulfillment services and Walmart+ membership program, Walmart is not only enhancing its offering to customers, it's also collecting valuable first-party data.

By leveraging this data, Walmart is able to understand customer behavior in great detail. This knowledge allows them to tailor offers and communications to specific customer segments, creating highly relevant, personalized experiences.

It's a cycle:

- Low prices and deep fulfillment discounts attract customers to Walmart’s membership plans.

- Membership plans lead to more frequent purchases, increasing customer engagement.

- More purchases provide valuable data about shopper preferences and behaviors.

- This data is then used to create personalized offers and communications tailored to specific customer segments.

- Customers receive relevant discounts and offers, reinforcing their loyalty and encouraging them to continue the cycle by making more purchases.

This personalization strengthens grocers’ high-touch service and helps them compete with Walmart by emphasizing their unique strengths.

Display Execution

How Can Grocery Retailers Adapt It?

Competing on national brand pricing isn’t sustainable for most regional grocers. Instead, they should focus on promoting private label products with key adaptations:

- Leverage Private Labels as Differentiators: Go beyond affordability by highlighting locally sourced, organic, or specialty items that appeal to customers seeking quality over mass-produced goods.

- Make Private Labels Visible: Promote private labels prominently in-store and online, featuring them in search results, shopping carts, and marketing materials as cost-effective alternatives to national brands.

- Emphasize Perimeter Departments: Focus on fresh offerings like produce, deli, and bakery, while promoting private labels in center aisles to keep customers from cross-shopping.

By leaning into their strengths—fresh departments, local connections, and personalized service—regional grocers can offer a high-quality, tailored experience that Walmart can't match. Private labels provide value without sacrificing margins, attracting customers who value quality and low prices.

Walmart's private label strategy, highlighted by the launch of its premium brand "bettergoods," goes beyond offering cheaper alternatives to national brands. This approach helps Walmart cater to diverse customer needs while boosting margins.

Its core private labels provide budget-conscious customers with additional savings, keeping Walmart the top choice for value-seekers. With bettergoods, Walmart is now expanding its appeal to include regular supermarket customers who prioritize quality, freshness, and premium offerings.

As consumers increasingly seek value, Walmart’s private labels deliver competitively priced essentials while bettergoods offers premium quality typically found at supermarkets. This blend of value and quality allows Walmart to compete in areas where local grocers once excelled, pushing regional grocers to further differentiate through their fresh, high-quality products.

Providing a Streamlined Omnichannel Experience

Up until now, we've primarily discussed eGrocery strategies, but one area where Walmart truly excels is in creating a seamless shopping experience across online, mobile, and in-store channels.

This allows customers to move effortlessly between shopping experiences—whether it's online grocery shopping or visiting the actual retail store—converting one-time transactions into repeat engagements all within its ecosystem.

As a result, Walmart’s share of US households in the overall grocery market, both in-store and online, has risen to 30% over the summer months of 2024 and it's showing no signs of slowing down.

How Can Grocery Retailers Adapt it?

Offset Costs with Retail Media

One of the ways Walmart is able to offset the costs associated with the deep discounts, advanced technology investments, and other strategies we’ve discussed is through its vast retail media network.

Walmart monetizes its digital real estate by allowing consumer packaged goods (CPG) brands to advertise directly to customers as they shop online. This strategy allows Walmart to generate significant revenue through targeted ads, banner placements, and sponsored product listings on its website and mobile apps.

By tapping into the retail media market, Walmart has turned its eCommerce platform into a powerful advertising space, where CPG brands are willing to pay a premium to reach consumers at the point of purchase. This additional revenue fuels Walmart’s customer acquisition and retention efforts, creating a self-sustaining cycle of continued growth.

While "becoming omnichannel" is simple to suggest, the reality for grocers is much more challenging.

Competing with Walmart requires more than just plug 'n' play eCommerce or implementing curbside pickup. True omnichannel success demands a seamless experience across platforms, which is easier said than done.

Two key challenges stand out for grocery stores:

- Limited Resources: Big players like Walmart invest heavily in advanced technologies to create seamless omnichannel experiences, making it tough for regional grocers to match.

- Translating In-store Service Online: Grocers excel at in-store personal service, but replicating that warmth digitally can be difficult.

Contextualized commerce offers a solution for grocers that utilizes technology to blend traditional areas of strength—local service and personal connections—with the convenience of online grocery shopping.

And most importantly, it allows grocers to connect across multiple channels without the need for a huge, Walmart-sized budget. It unifies customer data and interactions across online, mobile, and in-store to deliver a personalized, cohesive shopping experience.

Here's how to implement this kind of omnichannel experience:

- Unify Customer Data: Gather data from all touchpoints to offer timely, personalized recommendations across multiple channels.

- Personalize Every Step: Make each interaction personal, from targeted promotions to customized customer loyalty programs, fostering deeper connections.

- Implement Seamless Fulfillment: Integrate options like in-store pickup and same-day delivery to ensure flexible, convenient shopping that aligns with your brand's values.

This isn't so much an adaptation of Walmart's omnichannel strategy as it is a more cost-effective means of implementing it. Contextualized commerce lets grocers deliver a personalized, cohesive experience across all platforms without requiring the massive budgets of big-box retailers.

How Can Grocery Retailers Adapt?

Implementing a retail media solution isn’t without challenges, but an oft-cited concern—regional grocers being too late to compete with giants like Walmart—is a misconception.

While it may seem daunting, regional grocers actually have a unique opportunity to build and leverage their own retail media networks. This past summer, an insightful article was published by Emarketer on regional retail media networks providing advertisers something larger networks cannot: a highly targeted, loyal customer base.

Rather than competing head-to-head with Walmart, regional grocers can once again focus on their strengths—close customer relationships and local knowledge—to provide closer connections to consumer packaged goods (CPG) brands. This gives advertisers access to a highly engaged audience that, as Emarketer points out, larger networks often struggle to replicate.

By using these strengths, regional grocers can create retail media networks that deliver personalized, community-centered advertising, strengthening their ties with consumers and advertisers alike.

Here’s how regional grocers can set up their retail media strategy for success, ensuring efforts are well-targeted, effective, and capable of driving sustained growth:

- Evaluate eCommerce Traffic and Order Data: Analyze site traffic and customer behavior to determine the best ad placements and revenue potential.

- Choose the Right Retail Media Solution: Select a platform that fits your business needs and scales as you grow, balancing in-house work with external support.

- Capitalize on Both Web and Mobile Traffic: Optimize ads for all devices to maximize impressions and engagement, especially among mobile users.

- Develop In-house Expertise: Build internal capabilities to manage ad placements and create tailored campaigns for stronger control and results.

- Monitor Key Metrics: Track key performance metrics like CTR and ROAS to adjust your strategy and continually improve ad effectiveness.

Leaning Into Your Strengths—The Ultimate Playbook for Grocery Stores

At its core, Walmart’s overarching strategy isn’t just about low prices—it’s about maximizing its own strengths and turning them into competitive advantages regardless of current market trends.

By identifying and adapting these individual strategies, regional grocers can’t help but adopt a similar overarching approach. The goal isn’t to mimic Walmart, but rather to lean into what makes your business unique—the local connections, high-touch service, and fresh offerings that big-box retailers struggle to replicate.

In doing so, you not only enhance your competitive advantage but also position your grocery store as the go-to destination for customers who value personalized service, convenience, and quality. Walmart may dominate the market, but by doubling down on your strengths and communicating them effectively to your audience, you can better retain customers and regain your market share.

Mercatus helps you reinforce those strengths with our all-in-one eCommerce platform that provides complete control over your:

- Customer data

- eGrocery operations

- Loyalty programs

- eMarketing campaigns

- Fulfillment options

- Retail media connections; and most importantly

- Customer experience

Whether you're looking to implement contextualized commerce for deep personalization, optimize operations, or streamline your digital marketing efforts, Mercatus is more than just a technology provider—we’re your technology partner. We offer ongoing guidance and support long after implementation, helping you leverage your unique strengths to compete with larger players.

Ready to make your strengths stand out? Let’s talk.

Contact us today to learn how these strategies can be tailored to your grocery operations to boost sales, increase customer loyalty, and set you up for long-term success.

Mercatus

Mercatus began in 2004 as a privately funded group of passionate innovators who identified a gap in the grocery retail technology market. Focusing on both hardware and software, we commercialized an intuitive, small-screen computer for grocery carts. It offered shoppers coupons, recipe ideas, loyalty rewards and more, all served up at their fingertips in-store. We’ve come a long way since then.

Mark Fairhurst, Chief Growth Officer at Mercatus