Grocery Retail Transformation: Driving a Successful Omnichannel Strategy

By Mark Fairhurst, Chief Growth Officer, Mercatus

Grocery shopping patterns in the US have seen their ups and downs in the past couple of years. It’s now clear that some of the major shifts and trends observed are here to stay, while others have already faded.

2022 was the year of omnichannel grocery, when mobile redefined grocery shopping. Customers started expecting grocers to offer multiple channels with which to engage, shop and fulfill orders. The year saw home delivery take a backseat to pickup, which became the preferred fulfillment method among cost-conscious shoppers. Meanwhile, rising inflation costs led consumers towards private label brands.

Traditional Retail Grocery Key Performance Indicators (KPIs)

Basket Size

Customer Acquisition Costs (CAC)

Moving forward into 2023, sustainability and finding a path to profitability through omnichannel strategies should be top of mind for grocery executives. It’s important to formulate an eCommerce strategy that will empower you to build and retain your online shopper base by offering competitive services, while effectively managing the costs of operating an online store.

There are some metrics exclusive to the brick and mortar grocer because they apply only to physical space, such as sales per square foot. There are, however, a number of traditional metrics that do offer operational value for omnichannel grocers both in store and online.

Which measurements are of mutual interest to both regional grocery stores and online grocers? Against a long list of traditional grocery industry KPIs, several are worthy of note.

Grocers focus extensively on basket size, especially cross-category. A favorite grocer’s line is, “If I could sell just one more item to each customer in a category/department they usually ignore, my numbers would go through the roof.” Online sales offer both an opportunity to increase share of basket size and an ever-present threat as competitors take their share at your expense.

This is essentially the marketing and promotions budget versus the operating budget. Doing online right is not an inexpensive undertaking. Grocers need to invest in above- and below-the-line promotion as well as digital content development.

Measuring success along the digital journey requires a rethink of traditional retail key performance indicators (KPIs). In some cases, we can look to the software world for insights. What follows is a guide aimed at helping grocery executives evaluate which measurements will best help you evaluate your current state and decide your next course of action.

Read on to learn which KPIs you should monitor to ensure your omnichannel grocery strategy is on the path to success in 2023 and immune to fluctuations in industry dynamics and consumer demand.

Customer Lifetime Value (CLTV or LTV)

For venture capitalists, the favorite metric in any pitch deck is the CLV/CAC ratio. CLV is a prediction of each customer’s profitability over their entire (past and future) relationship. The calculation looks like this:

CLV equals the present value of the cash flows that a customer generates while engaged with the firm minus the cost to acquire the customer. It’s used to predict all the value a business will derive from its entire relationship with a customer. Ideally, a customer ought to generate at least 3 times what it cost to acquire them, with the initial payback being under 1 year. Read our blog on customer lifetime value to learn more about how you can measure and track for your business.

Cart Abandonment Rate

Inventory Levels

Frequency of Shop

Stock Turns, Sell-Through Percentages and Inventory Levels are generally the same if eCommerce sales come from local stores, and not central distribution. Although theoretically the notion of “one in/one out” shelf space allotment doesn’t apply to digital selling, the reality for most regional grocers is that the item bought online comes directly from the same local store so the KPI challenge remains the same.

This is an interesting metric because, not unexpectedly, the availability of click-and-collect and home grocery delivery options change shopper behavior. Old models of measurement need to be readjusted to account for new combinations of frequency, basket size and category mix as shoppers venture both online and in-store.

This is generally a bigger concern for online platforms, especially mobile, but it happens in-store as well, as shoppers walk through specialty departments and then choose to buy elsewhere. According to research from the Baymard Institute, almost 70% of all online shopping carts are abandoned. A long or confusing checkout process, limited availability for pickup/delivery, or lack of desirable payment options are a few reasons why customers might abandon their cart.

Shrink

Theft, damage and spoilage occur in warehouses as well as stores. And with the massive influx of third party marketplaces fulfilling orders, the question of “who owns it” becomes more difficult to answer.

Display Execution

Customer Satisfaction Score (CSAT)

Grocery Fulfillment KPIs

CSAT is a grocery retail KPI that directly indicates customers’ satisfaction with product quality, customer service and the overall experience you provide. It reveals where you are succeeding from the customer’s point of view, and areas for improvement that you can work on.

From the onset of the pandemic, we’ve seen a growing focus on retail KPIs related to online grocery fulfillment. Improving measurements in this area can help to both increase customer satisfaction and ensure financial sustainability.

This metric has interesting implications for eCommerce, since most online visuals are pictures within pictures – pictures of packages that often have pictures of the product on their label. In the not-too-distant future, CPGs will realize it makes more sense for online visuals to be of the actual prepared product.

Fulfillment Cost Per Order (CPO)

You may already be measuring the direct labor required to pick, pack and hand over each order and interface with customers. Be sure to include other associated expenses, such as indirect labor (for example, handling returns), extra packing supplies, facility costs if you have added to your retail footprint, delivery service providers, and the cost of managing your online order site and app.

Average Time to Fulfill an Individual Order

Substitution Rate

Average Wait Time at Pickup

This has become a hot topic since the start of the pandemic, when grocery retailers across the country were faced with stock issues due to a combination of panic buying and shipment delays. Many grocery retailers, especially at the beginning of the pandemic, were challenged with maintaining accurate stock count on their eCommerce sites, resulting in an influx of substitutions or orders that were missing products.

The length of time that a shopper waits for their order at curbside is a key factor in their satisfaction with that service. Monitoring and improving this KPI will empower grocers to build a strong relationship with their new and returning online shoppers.

This runs across the entire fulfillment process, from processing the online order and payment, to picking and packing the order, to the amount of time that all personnel spend interacting with the customer.

The Challenge of Recasting Traditional KPIs for Omnichannel Grocery

Integrating Marketing KPIs for eGrocery

Traditional grocery KPIs cannot always translate to tracking performance online. Although the tracking methods may seem familiar, they require an in-depth understanding about how they function in the eCommerce context in order for omnichannel grocers to properly analyze and apply them.

Take foot traffic in retail stores as an example. Eyeball tracking in the online space seems like it would be comparable, but it doesn’t function in exactly the same way.

Similarly, online shopping cart abandonment – which occurs when customers visit a site but don’t complete the purchase – isn’t the same as in-store cart abandonment. That’s because many shoppers go online to do their research, and then head in-store to make the purchase.

Linking online activity to a subsequent in-store purchase is challenging. But measuring eCommerce-only grocery activity and sales as if eGrocery represented a stand-alone store misses the mark, as it misrepresents this popular shopping behavior of online research culminating in purchases at the store.

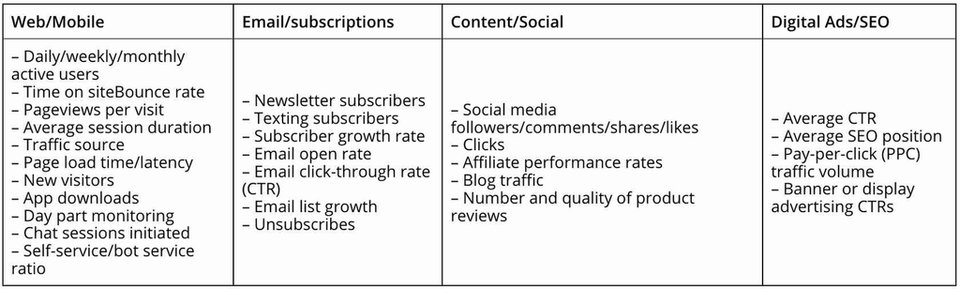

For eCommerce businesses, the most frequently used metrics come from digital marketing practices. The list is lengthy:

It’s difficult to find key performance indicators in this list that will resonate with a grocery executive. Of course, mobile site traffic and new (vs. returning) customers spark some interest, but only in tandem with “how many shoppers” and “how much did they spend?”

The problem with marketing KPIs in general, and digital marketing metrics for grocers in particular, is they are in constant danger of becoming surface level “vanity metrics.” Like social media followers and likes, they impress the audiences they were built for, but fail to impress business owners. In many instances, these KPIs don’t just miss the mark, they mask ills that can go undiagnosed and untreated.

Grocery Executives – Thinking Like A Software Company

OKRs: Objectives and Key Results

Measurements support growth

Complaints from shoppers in the store are difficult to ignore. Angry or upset customers typically are “in your face” and there’s a tendency to inflate customer problems into bigger issues. With online experiences, it’s the opposite. It’s easy for customers to “walk out” on the relationship with the grocer and equally easy for those responsible to keep this reality hidden even as customer relationships are poisoned with click-bait, spamming, poor UI design and lack of integration across channels. Few take the time to properly measure downside metrics.

Poor uptake on an email push campaign, for example, should prompt inspection as to why and what, if any, damage occurred. Unfortunately, that rarely occurs. Instead, the reflex of many marketers is to double down, deploying additional poorly designed campaigns hoping for a positive number to showcase. Spamming and click-baiting are not the fault of basement hackers; arguably they are the well-intentioned and ill-informed vanities of digital marketers.

By contrast, clarity metrics are operational metrics that represent “the hidden gears that drive growth… [and] solidify your competitive advantage.” They help businesses of all kinds – regional grocery included – to acquire new customers and to retain their current customers as new offers come to market.

Online, in particular, provides a gear to achieve that one essential, needed cross-category sale every grocer looks for. Why not have a Category Development Index that measures cross-category basket sales and determines if it’s shrinking or growing, including online’s contribution to this metric?

The answer to the metrics conundrum may be for the regional grocer to think like a software company while solving for their online business in the grocery industry. The ideal reality for a grocer to pursue is for customers to be online and drawn into the store while away, and when in-store to interact online in pursuit of an ideal personalized experience. In light of this goal, new metrics need to be in place. Consider, for example, Unique Household Interactions, a measure that embraces the buying power of a consumer household in an omnichannel world.

Since the pandemic, many grocers have invested in building or enhancing their eCommerce offerings, venturing into high-demand and higher margin spaces such as prepared meals, private label products and locally grown produce.

But simply offering these products online isn’t enough. A Prepared Meals Penetration metric is necessary to track the revenue of this program, and identify opportunities for further growth, such as digital partnerships with CPGs, for example.

The power of these metrics is that they change the conversation from the outset. Many digital solutions want to grab share by tackling the easiest part of the opportunity without focusing on what drives value for the grocer.

In the long run, the hard parts like prepared meals are where the win-wins can be created. Getting new, complex things done is familiar ground for large successful software companies. Interestingly, many have turned away from traditional key performance indicators and instead have turned to OKRs.

OKRs are goal-oriented systems used by software companies. Google started using OKRs in its first year back in 1999, and still uses them today. We use OKRs at Mercatus as well. Like a KPI, they are a metric-based tool that creates alignment and engagement around measurable goals.

Unlike KPIs and traditional annual planning methods, OKRs are frequently set (usually quarterly), tracked and re-evaluated. The short-term, goal-oriented measures of OKRs help create a much faster cadence, and they do so from the ground floor up, engaging each team’s perspective and creativity.

Consider what software companies do and apply it to the grocery industry. Specifically, think about what Google really is. It claims to be a search engine, but its primary goal is to provide a “direct response advertising engine optimized to put the right ad in front of the right person at the right time.” Now think about what your grocery eCommerce site is.

To the public, grocery eCommerce is an online storefront with a search engine and purchase capabilities. Like Google though, its real value lies in being an advertising engine optimized to put the right products in front of the right shopper at the right time. It tells you what each of your customers likes to buy, how often they like to buy, and what’s on their shopping list.

Grocery eCommerce is the opportunity to build a personalized shopping experience tailored to every individual shopper’s needs. It should be the number one reason that your shopper never feels compelled to look further.

With this as your objective, every department in your grocery business should be tasked with imagining how they contribute to new, creative ways to bring highly personalized convenience to customers. OKRs can help by focusing everyone, not just the marketing department, on how best to engage digital shoppers so they become repeat customers and purchase across a broader mix of categories.

And when new big programs are implemented – such as contactless curbside pickup or delivery of hot and fresh ready-to-go meals – each team can rally around their own measured contribution to achieving these goals.

With the right metrics in place, regional grocery executives can navigate the strong winds of change that carry with them enormous opportunities for future margin growth and profitability. Findings from our 5 year forecast, conducted in collaboration with Brick Meets Click, project that the online grocery industry will account for 13.6% of total grocery sales in 2027 – up from 11.2% in 2022.

Grocers who invested in improving and expanding their eCommerce to meet shopper needs enjoyed the greatest revenue gains year over year out of all retailers assessed. When you invest in optimizing your own eCommerce experience, balanced with your omnichannel strategy, you will not only protect market share, but foster future growth for your business.

Mercatus

Mercatus began in 2004 as a privately funded group of passionate innovators who identified a gap in the grocery retail technology market. Focusing on both hardware and software, we commercialized an intuitive, small-screen computer for grocery carts. It offered shoppers coupons, recipe ideas, loyalty rewards and more, all served up at their fingertips in-store. We’ve come a long way since then.

Click to edit...