Combating Retail and E-Commerce Fraud: Insights from Telesign's Advanced Solutions

It all started with a simple 2FA, back in 2005, which was a revolutionary way to authenticate your users. It is something that is an industry standard today, but we came a long way from simple authentication. As fraud techniques were evolving, we had to be one step ahead of fraudsters.

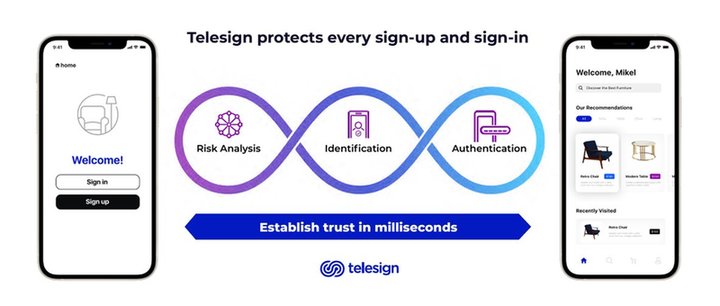

Telesign's solutions help businesses in the e-commerce and retail sectors combat emerging fraud threats by providing a range of tools and services that enhance trust, security, and customer experiences. These solutions are designed to address various stages of the customer journey, from onboarding to account integrity and omnichannel experience.

Telesign uses a multi-layered approach to detect and prevent suspicious accounts from entering the platform, and these tools seamlessly integrate with retail platforms.This includes real-time digital identity and behavioral risk signals, which help identify signals of promotion fraud for example and making sure businesses are selling to a real person.

By layering these signals into sign-up and transaction workflows, businesses can detect fake accounts and prevent synthetic identities from causing harm.

Telesign also has ways to detect suspicious transactions, account behaviour and adopt a proactive, multilayered approach to prevent fraud, such as SIM swaps and password resets, ensuring the security of customer accounts.

Telesign uses a multi-layered approach to detect and prevent suspicious accounts from entering the platform, integrating seamlessly with retail systems.

Can you discuss how Telesign's approach to digital identity and fraud prevention datasets has evolved to address the unique challenges faced by the retail industry, particularly with the surge in online transactions?

Given the rise of sophisticated fraud techniques in retail and e-commerce, how does Telesign's solutions help businesses in these sectors specifically combat emerging threats?

With the integration of phone number verification and two-factor authentication, what improvements have you observed in preventing promo abuse and chargeback fraud among your retail clients?

Telesign has always listened to its customers. As I mentioned earlier, it all started with two factor authentication, but our customers came back to us with feedback - that it works to a certain extent. Fraudsters started to find workarounds to combat 2FA, so our customers needed our help. This is when our evolution in battling combat started and is continued to this day.

We used this feedback from the field to create new tools such as Telesign’s Intelligence, which assesses the behavior of a phone number in a digital world. Intelligence is a machine learning system that analyses vast amount of data, including user behaviour and transaction patterns in real time, helping our customer make more informed decisions on the go.

We understand that one shoe does not fit all, so we have options to develop customized fraud prevention models, that are tailored to a customer’s specific needs and challenges. Every customer is unique, even if they come from the same business vertical as e-commerce, they will be facing different varieties of the same fraud.

It all depends on their business and user flows. Some might struggle with fake accounts being created with different email addresses in combination with phone numbers, while with others, it might be the IP addresses that are the giveaway for a fraud. The outcome is the same, fake accounts with the idea to inflate traffic (artificial inflation traffic fraud), or to abuse perks like promotions for new users or even chargebacks.

I often like to say that there are bigger chances of me leaving my house without my head than without my phone, and this is the reason we utilize phone numbers as a link between digital and real world.

When building any kind of anti-fraud system, businesses always consider the user experience and are hesitant to introduce more friction, therefore a delicate balance needs to be maintained.

Having the users authenticate their phone numbers via 2FA is a great initial step (and industry standard today) to understand that the user is in the possession of the phone number and is not sharing their neighbors’ phone.

It also makes it more difficult (but does not stop) fraud types, like promotion abuse, as people need to have access to more numbers. This is when they reach out to online VOIP (Voice over IP numbers), to bypass the 2FA, or buy hundreds of numbers for the sake of multiple account creation.

Down the line, this creates many problems for the e-commerce businesses:

Combating Retail and E-Commerce Fraud: Insights from Telesign's Advanced Solutions

By Stefan Stankov, Senior Solutions Engineer - Team Lead, Telesign

- Artificial traffic inflation – businesses get tricked into sending 2FA messages to fake accounts, leading to an increased SMS bill in the end of month that they have to pay for

- Promotion abuse – new accounts have a complimentary money in the wallet, or a discount on the first purchase/delivery.

- Growth that is not organic, which more mature businesses are trying to get rid of, as fake accounts can be used to defraud other users endangering platform integrity.

- Accounts that create a distorted picture, boost ratings for certain products, services and merchants, by posting inaccurate reviews. It also works the other way around, eliminating the competition through negative comments.

- Chargeback fraud – as many of these accounts can be used to test/use stolen credit cards, eventually ending up in a dispute.

With the dynamic landscape of digital fraud, how does Telesign's omnichannel communication strategy adapt to new threats, particularly in sectors like e-commerce that are prone to high levels of fraud?

The user won't be aware that the anti-fraud system is working nonstop to protect their account because Telesign has numerous strategies in place to combat this kind of fraud.

While Telesign is in the background interacting with the platform, we can verify in a matter of milliseconds, for example that the name and address you gave correspond to your phone, thereby confirming to the platform that you are who you say you are or that there is no questionable online activity associated with your phone number on other platforms.

With these tools in place, we received feedback from some of our customers that AIT (Artificial traffic increase) fraud was reduced up to 98%, chargeback fraud by 25%, and we provide an additional uplift and prevent fraud that some customers were not aware of.

With the rise of smartphones, online user habits and expectations have shifted dramatically. This is allowing companies to provide different services to maximize user experience and meet their needs.

As more and more companies are shifting away from the standard SMS as an authentication and communication channel, Telesign's omnichannel approach allows businesses to reach and authenticate customers seamlessly, increasing conversion, engagement and improving the overall customer experience.

New channels of authentication like silent verification, push notification or through WhatsApp are just part of the growing trend.

As it brings variety and flexibility, it is still a fertile ground for fraudulent actions.

As previously described, these fraud attempts can be thwarted if you know what to look for and how the fraud looks like. A fraudster’s goal is still the same: to exploit the platform for money in any possible way, inflate the traffic, use the credit card, just in a different way.

From the account creation, sign in, to password resets, account updates and transactions, different approaches can be tailored based on the needs of the customer, their existing setup, internal anti-fraud engines and other vendors.

As nobody can claim they can obstruct 100% of the fraudulent attempts, Telesign believes in multi-layered approach when it comes to battling fraud, as more obstacles you put in fraudsters way, more likely they will give up.

What do you see as the biggest challenge for retail and e-commerce sectors in maintaining security and loss prevention in the next five years, and how is Telesign positioning itself to address these challenges?

One of the biggest challenges for the retail and e-commerce sectors in maintaining security and loss prevention in the next five years is the increasing sophistication and frequency of cyberattacks and fraud attempts. As technology evolves, so do the tactics used by cybercriminals, making it challenging for businesses to stay ahead of emerging threats.

Telesign is addressing these challenges by continuously innovating and expanding its suite of security solutions to adapt to the evolving threat landscape. We will continue to rely on our customers’ feedback and tune our solutions in collaboration with industry partners, cybersecurity experts, to share threat intelligence, best practices, and resources to combat cybercrime effectively.