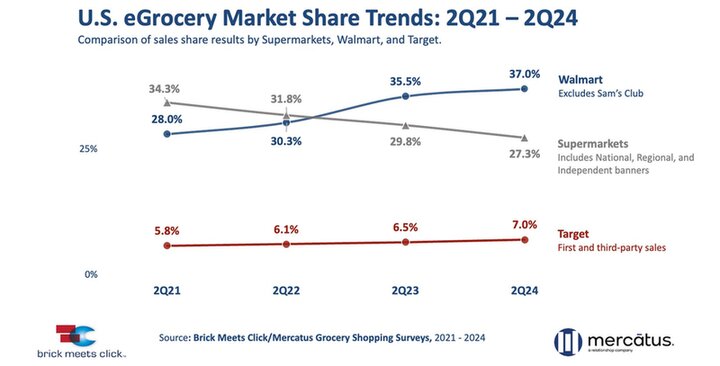

The Q2-2024 edition of the US eGrocery Market Share Report from Brick Meets Click and Mercatus reveals that Walmart captured 37% of the US online grocery market in the second quarter of this year.

This marks the big retailer’s highest share of the eGrocery market to date. In contrast, the Supermarket segment ended Q2 2024 with only a 27.3% share of online grocery sales.

This shift in market share from grocer to mass retailer is largely due to changing consumer drivers, with value and convenience now taking center stage in purchasing decisions.

Holly Hall, Managing Director, MACH Alliance

Value Imperative

Nearing the end of 2023, larger retailers overtook supermarkets as the grocery shopping destination of choice among U.S. households— both online and in-store.

The U.S. eGrocery 5-Year Sales Forecast from Brick Meets Click and Mercatus confirms this has been primarily driven by a pronounced flight-to-value, in which consumers actively seek lower prices from multiple retailers to extend their grocery shopping budget.

Convenience Necessity

The same report also suggests that eGrocery has secured a large and stabilized segment of the market, marking a fundamental change to how US households purchase and receive their groceries.

Customers have quickly grown accustomed to the convenience of digital shopping experience, and now total eGrocery sales are projected to reach $120 billion annually by the end of 2028, growing at a rate more than three times faster than in-store sales.

What’s Next?

This change has been abrupt for many grocers, whose core value proposition still centers on in-store, high-touch customer service. But that does not mean grocery retailers should completely reset a service model that has served them well for decades. Instead, they need to bring it into the digital experience by:

- Adapting the personal approach of their traditional service model to the digital experience; and

- Adopting value and convenience as part of the core value proposition offered to customers.