Online Grocery: On the Edge of the Next Transformation

Technological advances and changes resulting from the COVID-19 pandemic rapidly accelerated the development of the already promising online grocery market, helping top providers reach user bases and sales totals that otherwise would have taken several years to attain.

Prior to the COVID-19 pandemic, the U.S grocery sector was lagging other retail sectors in e-commerce adoption--penetration was 3 to 4 percent of the overall grocery sales. The pandemic changed that trajectory. With a threefold increase from pre-pandemic levels (10 percent penetration), grocers showed amazing resilience in adapting to this disruptive shift. Several of them executed projects at a breakneck speed. In 2017, just 9% of U.S. adults ordered groceries online monthly. Now 28%, report ordering groceries online for pickup or delivery at least once a month. "While online grocery ordering has picked up considerably in the past two years its use lags behind restaurants -- both for dining in and takeout," according to analysis of the Gallup Poll conducted in July, 2022 for its annual Consumption Habits survey.

To get a better sense of the shift, earlier this year McKinsey conducted research on retailers and consumers. In its State of the Grocery North America report, McKinsey observes, "Over the past 24 months, ecommerce in the North American grocery industry has continued to mature and scale. The pandemic served as an accelerator for grocery e-commerce, with much of the sector experiencing the equivalent of more than five years of growth in just five months."

Online grocery sales nationally are estimated to be $140.2 billion this year, or 9.9% of total grocery sales. It will be the first time online groceries represent 10% of the total pie. Pickup continues to be the preferred online shopping method for consumers, accounting for 39% of ecommerce orders, while delivery accounted for 31% in July. Order share among ship-to-home services continues to decline, and is now under 30%, according to the latest monthly e-commerce report from Brick Meets Click and Mercatus.

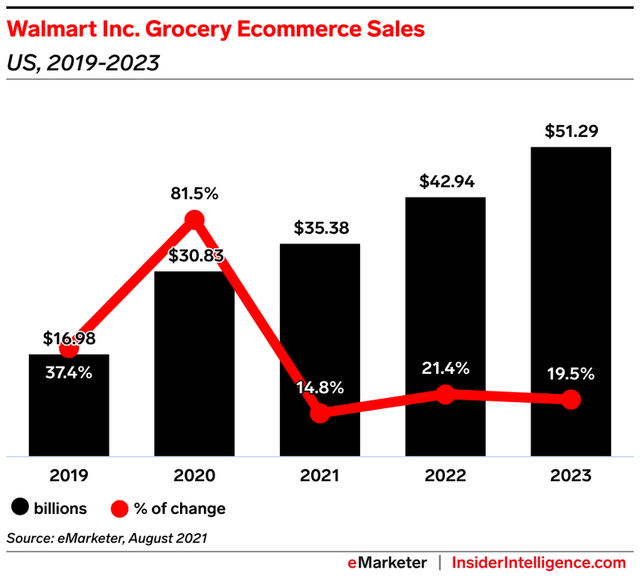

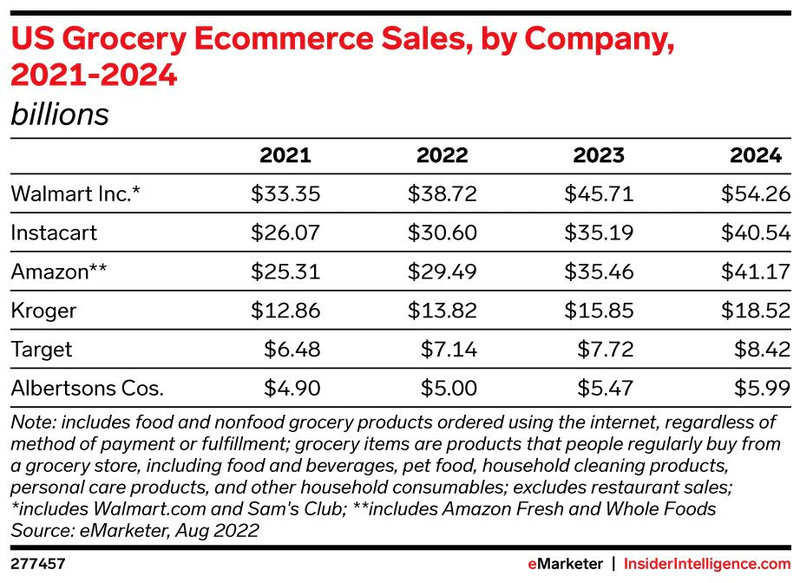

Grocery has become a battleground for many of the top players in ecommerce. Walmart holds a comfortable lead as the largest online U.S. grocer, but there’s a fierce battle for No. 2 between Amazon and Instacart. Walmart will generate $38.72 billion this year in e-commerce sales, representing 27.6% of the online grocery market, according to new data from Insider Intelligence. Its sales include Sam’s Club, its members-only wholesale division. Last year, Instacart narrowly surpassed Amazon to become the second largest grocery ecommerce player in the US, a spot it holds in 2022. Insider Intelligence predicts Amazon’s grocery ecommerce sales will reach $29.49 billion this year, just under Instacart’s $30.60 billion. “Instacart’s partnership with local retailers gives it a leg up against Amazon, especially when it comes to fresh groceries. However, Amazon offers lower prices on shelf-stable items, which makes it more cost effective than Instacart,” Insider Intelligence says forecasting analyst Wendy Louie-Lam.

Grocery executives expect ecommerce penetration to more than double for their own organizations in the next three to five years, to an average of 23 percent. Executives are even more bullish on ecommerce’s upside potential, noting that penetration could nearly triple to as high as 35 percent (nearly $600 billion versus about $140 billion at 10 percent penetration).

While consumers will continue to favor ecommerce as one of many ways to shop, McKinsey report states that many grocers don’t believe they have the necessary capabilities to manage this channel. Executives understand that there are multiple elements in their current eCommerce business model that can negatively impact their brand and the business. For instance, they are realizing the need to cut down on their reliance on third-party for fufillment and delivery in order to improve profitability. In the long run, third-party services are expensive compared to setting up your own omnichannel solution that allows online shopping and store pickups. Furthermore, they now understand that outsourcing fulfillment or delivery will mean they lose all control over your customer touchpoints, no longer controlling customer experience and satisfaction. This also means you forfeit your right to your own customer data, which eventually means there is very little you can do to build custom experiences that can greatly influence the brand-customer relationship in the long run.

Executives are now forced to figure out the best alternatives for scalable, long-term business sustainability. The industry is now on the edge of the next transformation in ecommerce. The main drivers of ecommerce’s growth during COVID-19 were safety and convenience, but McKinsey's research found consumers also value the channel’s unique features—such as product comparisons, assortment, and personalized promotions. In parallel, consumers increasingly prefer home delivery (a rise from 48 percent in December 2020 to 63 percent a year later, which translates to an approximately $100 billion market today) and appreciate its product and service enhancements, including speed, reliability, assortment breadth, and flexibility. In order for grocers to be competitive, it is essential to maintain control over their customer data, experience, and margins, and a future-proof solution is the only way to achieve this.

The road ahead is full of challenges. Leading grocers will be defined by the differentiation, innovation, and defensibility of their strategies. As Grocery executives consider their course and priorities, it would be interesting to watch how each of the players will continue to build their digital and advanced-analytics capabilities to achieve omnichannel excellence.