Tyler Sickmeyer is the marketing thought leader and founder of Fidelitas Development, a full-service marketing and advertising agency that serves clients worldwide. Knowing that brand loyalty is a company’s most important asset, Tyler and his team implement unique and innovative strategies to accomplish the goals of their clients.

As a sought-after keynote speaker, Tyler has inspired audiences around the world with his unique perspective in sharing solutions for today’s marketing challenges. As the founder and host of The Lion’s Share Marketing Podcast, marketing leaders are treated to a wide range of topics, from Customer Acquisition Strategies and eCommerce best practices to the latest marketing and communications trends. Tyler showcases how integrated marketing and digital storytelling drive results in an ever-changing world.

As the youngest independent Christian concert promoter in the nation Tyler was the first to utilize text message marketing and Facebook for event marketing. He leveraged cutting-edge technology to provide data-driven results and continues to do the same today.

Tyler stays on top of the latest trends while serving on the board of Live Ventures (NASDAQ: LIVE). With a wealth of experience in digital and traditional marketing, along with PR and eCommerce, Tyler develops campaigns that stand out among crowded platforms while helping leaders navigate a path to successfully connect with their audiences.

Originally from Illinois, Tyler now calls San Diego home along with his wife, two sons, and yellow lab.

"It's 2022. This is the dawn of A.I. We have cars that can literally drive themselves. Then why can't retail stores?" questions Francois Chaubard, Founder & CEO, Focal Systems.

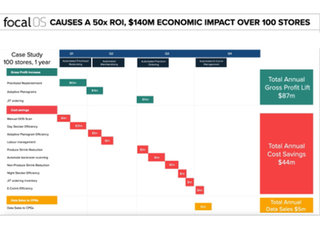

Born out of Stanford’s Computer Vision Lab, Focal Systems spent the last 7 years building and perfecting an AI-based operating system (FocalOS) that digitizes retail stores hourly, leveraging the same AI that is used in self-driving cars, and then uses that shelf digitization data to "drive" the store automatically, faster and better than ever before, resulting in a doubling of EBITDA for most of their partners. FocalOS performs many tasks for the store with perfection such as ordering, managing stockers on what to restock and when, planogram compliance audits, price tag audits, makes key merchandising decisions to grow sales, guides e-commerce platforms to only show what is available to eliminate substitutions, and much more.

The future of retail has to be built on a completely new operating system

"Most retailers cannot afford big expensive AI systems, so we have designed a powerful system that is less than they are currently paying now, so we know any retailer could afford it. We call it the self-driving store. It is a first of its kind, cloud-based, AI-powered Operating System purpose built for the current state of omni-retailing. It leap-frogs over traditional on-premise, legacy systems, some of which are older than me and not optimal in today's digital first world. We have partnered with some of the largest retailers in the world to help them digitally transform with AI and the results are staggering. We have been able to double EBITDA, but it’s not easy. They had to change every SOP they have ever developed. But the juice was worth the squeeze. They are now better positioned than all of their competitors." exclaims Chaubard.

In order to automate, you must first measure. Focal understood this from day one. "Retailers do not know where a particular product is in their stores, let alone do they know what is in their stores. This is the root cause of all inefficiency in retail—from labor, to shrink, to lost sales, and more," explains Chaubard.

To solve this, they deploy retail-ready, ruggedized, low-cost cameras that mount to the shelf and scan the shelves across from it every hour. Each camera covers 8 feet of linear shelf. Nearly 400 cameras are needed to cover a typical 30,000 square foot store. All of these cameras put together use less bandwidth than a single standard IP Security Camera! “So network strain is never a concern,” says Chaubard, “In fact, retailers need not worry as Focal will handle all maintenance and upkeep of the cameras forever.”

Once the cameras are deployed, Focal's ShelfCams digitize the entire store (sales floor and back room) every hour with high accuracy and feed data into FocalOS which is the engine that powers the Self Driving Store. Focal's ShelfCams cover the entire sales floor—produce, prepared food, pet food, you name it. “Focal’s Deep Learning Computer Vision is the most accurate shelf digitalization technology in the world. Trained on over 1.4B labeled images, this is our secret sauce! First, we remove all “people-pixels” to eliminate all PII (Personally Identifiable Information). Then, we detect ins, outs, lows, POG non-compliance, spoiled produce, and more for each UPC each hour,” explains Chaubard. Essentially hundreds of Focal's ShelfCams perform a wall-to-wall scan of the entire store every hour of the day for less than the cost of a full time employee. Focal’s hourly captured shelf data is then used by FocalOS not just for ordering and availability, but it automates category management, e-commerce management, staffing and labor management and so much more. As FocalOS captures more and more data it continues to learn and optimize the algorithms to further increase the impact of the recommendations. “This is why we call it the self-driving store and, if applied correctly, can double your EBITDA,” notes Chaubard.

Monitoring the Shelves: 24/7/365

Adaptive Inventory

There are 34,000 grocery stores in America. More than half of them still use manual data collection methods to write and submit orders which take 3-4 hours of labor a day that can be completely automated. Focal is doing it 24 times more often for less cost.

The rest of the retailers use a 20 year old method of inventory "debits and credits" that theoretically should work called "Perpetual Inventory" that depends on perfect receiving, no theft or breakage, and still 3-4 hours a day to keep inventory numbers up to date. As labor shortages continue, these systems are completely falling apart leading to out of stocks that shouldn't be there and over-ordering on product that does not need to be ordered. Even if they did solve these problems, these systems do not tell the store "where" the inventory is, so it could be on the sales-floor, in top-stock, in the backroom, or in the e-commerce packing area, leading to stocker inefficiency, trying to hunt down ghost inventory for hours on-end. We interviewed a stocker at a local grocery store who claimed: "I spend about half my day sifting through boxes in the backroom, trying to find a specific product that can go out. The system says it is here, but I usually can never find it. That is the worst part of this job."

Rest assured these legacy methods of inventory control are very broken and need a face-lift. A recent survey of 1,000 grocery shoppers cited in Winsight Grocery Business found that 65% believed that grocery inventory availability is worse than it was before the pandemic. In addition, almost half of respondents in households with children said their primary grocery store is out of one or more items on their list at least half of the time. Out-of-shelf instances continue to remain a major cause of lost sales. After further research, we investigated what percent of those out of stocks were actually in the backroom. One stocker told us, "Oh yea, that product is definitely somewhere in the backroom. But have you seen what a mess that place is? I don't even bother anymore. I just cycle count it and get more in."

FocalOS is reinventing inventory management, planogramming and eCommerce management by digitizing shelves, detecting key over-allocation and under-allocation trends on a per store basis, and creating and pushing down recommendations to fix those issues to grow OSA, Sales, EBITDA and NPS.

Retailers understand that they are judged by what's on their shelf. Optimizing on shelf availability is the number one goal of retailers because only what's on the shelf can be sold. Focal’s ShelfCams scan the sales floor and back rooms hourly in all stores and updates IMS based on what it sees. It provides the most accurate picture of the inventory. Accurate and frequent SKU level availability metrics allows efficient, automated micro- and macro-level inventory decisions that improve a store’s inventory position in ways simply not possible with prior approaches.

Today, retailers do not know what is in their back rooms. Even worse, they are paying 10-50 hours of labor a day to try to know with low accuracy. Either way it has to change. Focal ShelfCams in the back room helps retailers know exactly what is back there and get those boxes out of the backroom and onto the sales-floor.

A stocker at one of the leading retailers, which has installed Focal’s ShelfCams claims, “Since we got Focal, every order goes right to the shelf, our backroom is practically empty, and our shelves are more full than they have ever been. Sales are up and our store manager is happier than ever. The cameras do all the heavy lifting for us every hour of every day. It’s like having a super-power.”

Adaptive eCommerce

Leadership Can be Everywhere at Once

Adaptive Planogramming: Reinventing Category Management

Chaubard explains, "If you sell 20 cans of coke a day, traditional systems would estimate demand to be 20 a day because they only look at historical sales trends. But that is way wrong. Was it out of stock ever? Our cameras may see that, yea you sell 20 a day, but you are out of stock by 4pm every day, so you lose 40% of your sales opportunity every day. So true demand is 33 cans a day. And you never knew it until you had Focal. AdaPOG knows this information and adapts the shelf accordingly, without any human intervention."

Focal’s AdaPOG interface allows Category Managers to see exactly what is happening on the shelves, what the algorithms are doing, and how each store is performing. Managers can be in complete control of what Micro-Resets get pushed to stores, or can let the algorithms go on “cruise control”. From AdaPOG, Category Managers can delete SKUs, add SKUs, impose category blocking, and more. Supply Chain Managers can update Known Supply Issues and COGS as well. From there, AdaPOG has it covered. AdaPOG will adapt shelf allocation uniquely for every store’s specific buying habits and availability to ensure full, healthy shelves. This dramatically increases On-Shelf Availability and Sales, while decreasing labor required to constantly fill under-allocated SKUs.

The profound impact of the pandemic on consumer shopping habits saw retailers scrambling to expand their digital presence quickly. In grocery, e-commerce penetration has risen from 2 to 3 percent before the crisis to 8 to 10 percent in 2021 and its still growing. Yet the industry average for substitutions are over 20%.

"Can you imagine the analog equivalent? Imagine you are walking to your car after checking out with a full cart of 100 products. Then the cashier, who just checked you out, runs after you, and swaps out 20 products for what the cashier thought were good substitutes. Would that be acceptable? Why is it acceptable to do this in the digital world on every order? It's really crazy. They are talking about smarter substitution algorithms, but not reducing out of stocks. They are solving the wrong problem!" notes Chaubard.

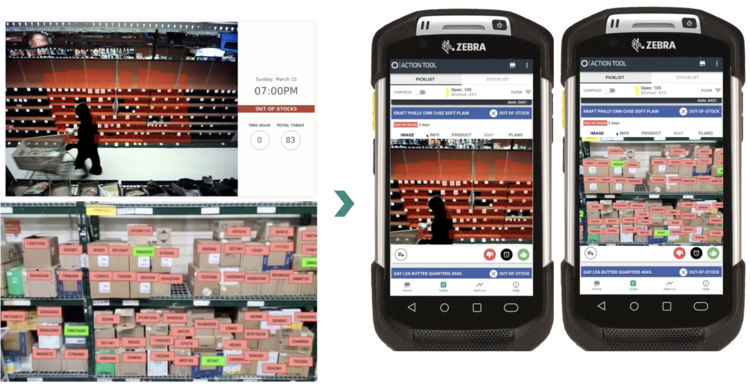

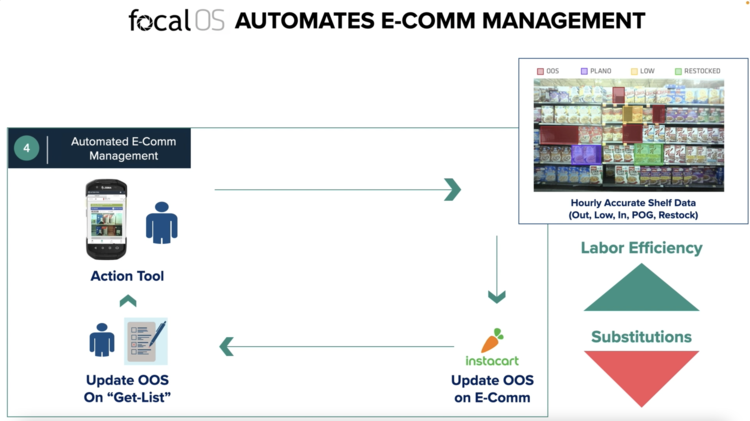

FocalOS solves this by updating e-commerce sites within an hour of an out of stock, so they only show in-stock products for orders that need to be filled in less than 24 hours. FocalOS also increases picker productivity since most of their time is spent on trying to find ghost inventory or chatting with the customer about what they can substitute out for. Such issues related to substitution doesn’t arise when using FocalOS. "No more outs and no substitutions, that is modern grocery," says Chaubard.

FocalOS enables C-suite, Corporate and Store Leaders to "teleport" into any store in real time. Focal’s Impact Dashboard allows store managers and corporate users to “virtually walk” any store, and see real-time images of their shelves, at any time of day, from anywhere. By teleporting to different stores, in seconds they can get high level metrics like number of out of stocks, scanned inventory in the back room, hourly on shelf availability and live lost sales estimates and productivity per associate. Focal also performs demand forecasting and “lost sales” analysis to determine the “cost” of those out of stocks.

In retail, many of the most important metrics such as On-Shelf Availability and Stocker Productivity is self-reported. This causes a dramatic misalignment between reality and what is reported. FocalOS is unbiased, and reports what it sees happening on the shelf, and ranks stores by their performance. This provides leadership a clear way to measure how stores are actually performing, and provides stores clarity in how they rank across the chain, in a fair way.

Over half of the out of stocks in a store have nothing to do with store execution. It has to do with supply issues and under-allocation. Today’s planograms are set to national or divisional averages on a quarterly or annual basis, without accounting for differences in store-level demand.

So if a retailer has 2 stores, and one store sells 1000 cans of coke a week and the other sells 1, the planogram for both will be 500, resulting in massive over-allocation in one store, and out of stocks in the other. Without the ability to adapt Planograms on a per store basis or to recent supply chain shocks and consumer demand changes, retailers will continue losing billions in lost sales due to under- and over-ordering. This is where FocalOS can help improve your planogram strategy and positively impact your bottom line.

Chaubard describes, "Retailers point the finger upstream on most out of stocks as vendor issues. But retailers have the ability to replace shortages with stock that is available quickly, but their old processes are in the way. If Kellogg's isn't shipping anymore, replace that shelf allocation with something that is shipping. Just update AdaPOG with the Supply Issue and the Fix It date, and bam, it creates the next best Planogram for you, optimized to that store, and then sends it to the stocker to implement the 'micro-reset'. It actually saves labor too since this means less out of stocks with more aligned shelf allocation on a per store basis. AdaPOG alone increases OSA from 89% to 95% and a 6% increase in sales, with less labor. It’s crazy powerful!"

Focal’s hourly ShelfCamera scans find under-allocated SKUs that are constantly going out of stock in the stores and spreads those facings out, removing some facings on over-allocated SKUs with AI algorithms to find the optimal shelf allocation over all SKUs that maximize EBITDA. Focal’s AI “adapts” planograms in real-time on a per store basis, to fix the issues related to under-allocation or over-allocation as soon as they are detected.

Focal Systems: The Clear Winner in Retail Technology

Amidst all the chatter and noise in retail technology, Focal Systems stood out to us as the most far along, the most robust, and the most reputable provider in the market. They are playing a vital role in the transformation of retail—providing retailers the ability to digitize and transform in an era when they desperately need it. With more than 50,000 Focal Shelfcams deployed across some of the biggest and most well-known retailers, Focal Systems’ proven Operating System streamlines all of retailer's stores in one comprehensive, AI powered system that just works, driving down shrink, substitutions, labor to sales, and driving up retention, NPS, and EBITDA. We could not find a close second. We are thrilled to watch them grow and transform this industry for the better. And we are excited for what they will think up next!