Is Your Holiday Gift Card Program Ready for Gen Z?

With their unique values and preferences, Gen Z consumers continue to drive transformation in retail. The impact of their influence will be felt this holiday as their consumer behavior shifts how brands and retailers prepare for the year’s busiest shopping season.

A forecast by eMarketer estimates that holiday shopping will top $1 trillion this year. Blackhawk Network (BHN)’s annual holiday research found that surveyed consumers plan to spend $770 on holiday gifting on average, which is a 3% increase over last year. Of that total gifting budget, surveyed shoppers plan to spend 43% on gift cards—a whopping 21% increase over last year that is largely fueled by Gen Z shoppers’ love for gift cards. Younger generations surveyed plan to buy 70% more gift cards this holiday season than older generations and also plan to spend 56% more on gift cards and 9% more on gifting overall.

As you prepare for holiday, here are three key considerations to help you optimize your programs for young consumers:

"Gen Z shoppers’ love gift cards. Gen Z thinks about and approaches gift cards differently than other generations. Be sure to embrace all shopping habits in your marketing plans."

Gen Z is shopping later but still on the hunt for deals.

Offer enough breadth of options to meet consumer demand.

Robust digital journeys and payments can drive Gen Z loyalty.

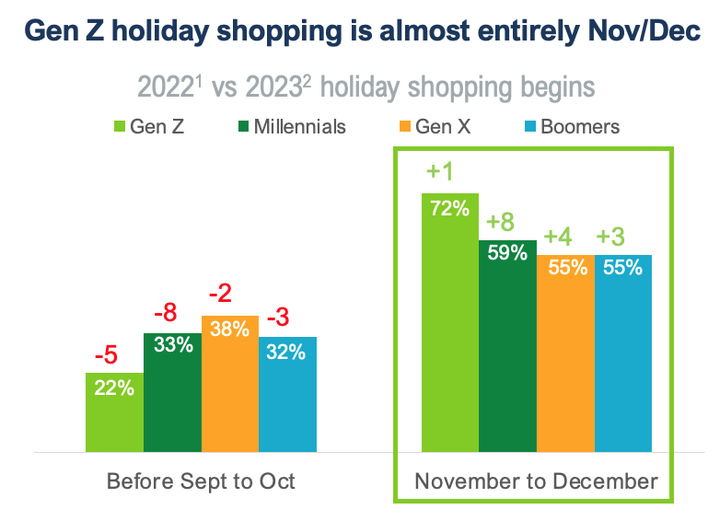

Many shoppers plan to start their holiday shopping later this year than in previous years—a shift driven by Gen Z consumers. BHN’s research found that 72% of Gen Z consumers surveyed plan to start shopping in November and December, with many reporting they won’t start until the end of December. As the most requested gift for nearly two decades, and a fast and convenient gifting option for last-minute shoppers, a later start is great news for gift cards. But it's important to keep in mind that plenty of shoppers are still planning to get an earlier start.

Many consumers—including 22% of Gen Z and 33% of millennial shoppers—are kicking off their holiday shopping before September or October, likely to help with budgeting, spreading out spending, and jumping on deals when they’re available. There will be widespread holiday deal-seeking as consumers try to stretch the value of their dollars with 60% of consumers planning to continue using—or more frequently using deal-seeking tools. Be sure to embrace all shopping habits in your marketing plans. Stay top of mind and drive return shopping visits through gift card promotions and by highlighting gift cards in areas with gifts that are often returned, too bulky to ship or for items that are out of stock.

Gen Z thinks about and approaches gift cards differently than other generations. While many consumers choose gift cards for choice and flexibility, Gen Z gift givers are also drawn to gift cards because they are also more conscious of giving a bad gift. Nearly half of consumers surveyed (46%) give gift cards because they allow the recipient to get what they want. Forty-six percent of shoppers surveyed also report that they will leave a retailer for a different store to find the gift card that they want, and 65% of consumers report that gift cards are a better alternative to a physical gift that the recipient may not want.

With these trends in mind, make sure you are offering enough breadth of options to meet consumer demand. Variable load, Visa/Mastercard and multi-brand cards are among the cards that consumers are most interested in giving this holiday season. For Gen Z, surveyed consumers reported clothing and accessories is their favorite gift card category to receive.

Digital gifting programs are an absolute must for both younger shoppers and retailers. Younger consumers plan to purchase 7 digital gift cards this holiday season, compared to older generations that plan to purchase 3 on average. eGifting programs can be implemented and adapted quickly and allow merchants to connect and engage with consumers whenever and wherever they are.

When it comes to holiday spend, younger generations also plan to use secondary payment types much more often than older generations, which can create new opportunities for revenue streams and promotions. While debit, cash and credit card payments remain the top three payment options among all generations surveyed, many younger shoppers will also look to store or credit card points (39%), mobile wallets (37%) and physical gift cards (37%) to pay for holiday gifts this year.

As Gen Z consumers continue to wield their influence and spending power this holiday season, consider expanding programs to include some of the newest ways to attract and engage young consumers while maintaining engaging relationships with older shoppers.

[1] “US Holiday 2022 Review and Holiday 2023 Preview” was published by Insider Intelligence on February 28, 2023.

[1] “BHN 2023 Holiday Branded Pay Study” was an online study conducted by Leger on behalf of Blackhawk Network (BHN) in July 2023. The sample size included 2,014 US consumers ages 18+.

[1] “2022 Holiday Gifting Report” was an online study conducted by Leger on behalf of Blackhawk Network (BHN) in August 2022. The sample size included 2,001 respondents ages 18+.

[1] “Inflation (and More)” is an internet-based survey conducted by Survey Monkey on behalf of Blackhawk Network (BHN) in June 2022. The sample size included 3,206 U.S. respondents ages 18+.

Brett Narlinger is Head of Global Commerce at Blackhawk Network, a global branded payments provider. He leads and drives growth across Blackhawk’s physical and digital retail businesses globally.