What Amazon Prime Day Tells Retailers About 2023 Holidays

Wondering what Amazon Prime Day 2023 can tell you about the upcoming holiday season? A lot.

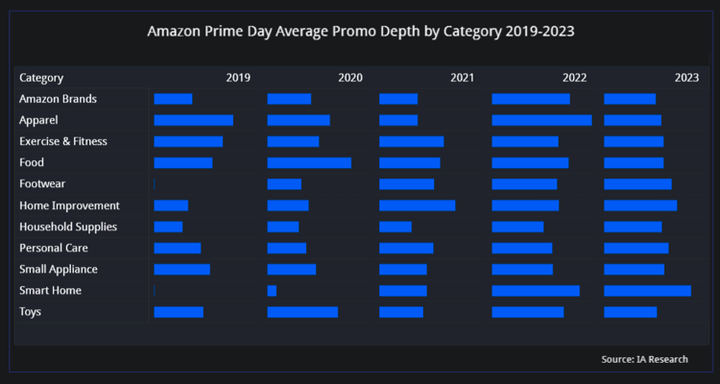

We analyzed Prime Day promotions across 11 categories over the last five years. YoY order size and promo depth for most categories was flat—except for essential goods (Home Improvement, Household Supplies, Personal Care), which were discounted more deeply and purchased more heavily.

Our analysis strongly suggests that, for several reasons, consumers will stay skittish for the rest of 2023 and focus their spending on nondiscretionary items—and retailers will continue targeting those items for discounts.

The 2023 Amazon Prime Day sale was Amazon.com’s largest ever. Over two days (July 11-12):

- Amazon.com customers worldwide bought more than 375 million items.

- Amazon.com customers in the U.S. spent about $12.7Billion.

Consumers, weary of inflation, were primed (as it were) for bargains and Amazon Prime Day 2023 delivered, offering more deals than any previous Prime Day.

Notably, however, the average year-over-year (YoY) order size barely budged, increasing from $52.26 to $54.05 (according to Numerator market research firm) and, based on data drawn from the Consumer Price Index, more than 80 percent of that increase was due to inflation.

Numerator also notes that consumers said their top two categories were Home Goods and Home Essentials. Taken together, these data points indicate consumers at mid-year 2023 were still feeling constrained—especially when it came to discretionary spending.

"Today, consumers are cautious, and retailers uncertain. As conditions shift or utterly transform, retailers must be prepared to make quick, tactical changes to their pricing and promotions strategy."

Prime Day Promotions Analysis: By the Numbers

A Mixed Bag for Consumers

Amazon Prime Day 2023 and This Holiday Season

Promo depth for most categories—such as Smart Home (more than 40 percent), Small Appliances, Footwear, and Exercise & Fitness—was largely in line with last year’s discounts. Essential Goods were discounted more deeply YoY while categories that suffered from excessive discounting last year corrected back to normal.

As noted, discretionary spending appeared restrained due to consumer skittishness (over high inflation and interest rates, macroeconomic uncertainty, etc.). Amazon and its vendors chose to apply their deepest discounts to Household Supplies, Home Improvement, and Personal Care items—an increase between 5 to 10 percent over last year. Base prices for the Home Improvement category increased by more than 30 percent while Household Supplies and Personal Care categories stayed mostly flat.

The COVID pandemic-induced inventory glut has largely dissipated, enabling apparel discounts to revert to the mean: Apparel promo depth dropped ~40 percent compared to Prime Day 2022, albeit on very high base prices, which stayed fairly flat after their sharp, more than 20 percent increase last year.

Many top-selling items across categories were heavily discounted.

The promo depth for Amazon brands also declined from last year.

Our analysis strongly suggests that, despite cooling inflation, a still-rosy employment picture, and the U.S. Federal Reserve’s fabled “soft landing” for the economy looking increasingly likely, consumers will continue focusing their spending on nondiscretionary items—and retailers will continue targeting those items for discounts.

Of course, there’s still a lot yet to process this year. Variables and unknowns include:

- Amazon sales events: Amazon appears poised to hold another consumer behavior-changing event, like its October 2022 Prime Early Access Sale.

- The war in Ukraine: The war recently forced Ukraine to shut down grain shipments with implications for the global food supply; things could take a variety of ugly turns ahead.

- The 2024 U.S. presidential elections: The campaign season is looking increasingly volatile with the frontrunner for the Republican nomination fielding multiple indictments.

- Interest rates: Going up?

- Inflation: Coming down?

All of which leaves consumers cautious and retailers uncertain.

As conditions shift or utterly transform, retailers must be prepared to make quick, tactical changes to their pricing and promotions strategy.

Prashant Agrawal is CEO of Impact Analytics, which provides Artificial Intelligence and Advanced Analytics solutions to leading companies. He previously co-led Private Equity and Corporate Finance for Boston Consulting Group in India and worked for former UK Prime Minister Tony Blair. He started his career as a senior consultant in the New York and Mumbai offices of McKinsey and Company. Prashant earned a BA in Economics and Government from Cornell University and his joint JD/MBA from Columbia University.